Offshore Company Formation: What You Need to Know About Legal and Financial Considerations

Offshore Company Formation: What You Need to Know About Legal and Financial Considerations

Blog Article

Offshore Business Formation: Unlocking International Service Opportunities

Offshore company formation offers a strategic avenue for companies looking for to enhance their global impact and enhance operational efficiencies. By choosing an appropriate territory, companies can take advantage of positive tax problems and privacy securities while accessing to varied markets. Nevertheless, the subtleties of legal conformity and the potential challenges usually continue to be misunderstood. As companies navigate these complexities, the question arises: just how can organizations efficiently take advantage of overseas frameworks to optimize their capacity without dropping victim to common misconceptions?

Advantages of Offshore Companies

In the world of international service, overseas companies use a myriad of benefits that can considerably boost financial strategies and functional performance. Offshore jurisdictions often supply favorable tax obligation routines, enabling businesses to lower their overall tax obligation concern legally.

Additionally, offshore firms can profit from greater privacy and privacy. Several jurisdictions impose rigorous privacy legislations, enabling local business owner to keep their anonymity and secure sensitive information from public scrutiny. This degree of privacy can be particularly helpful for high-net-worth individuals and business owners looking for to safeguard their assets.

In addition, the facility of an overseas entity can promote access to worldwide markets. By operating from a strategically selected territory, organizations can enhance their worldwide presence and expand their market reach. This global impact can also mitigate dangers connected with residential market fluctuations.

Picking the Right Jurisdiction

When selecting a jurisdiction, consider variables such as political security, economic environment, and the certain market policies that may influence your operations. Established offshore facilities like the British Virgin Islands and Cayman Islands are popular for their favorable tax obligation routines and versatile corporate frameworks, while jurisdictions like Singapore and Hong Kong offer accessibility to durable monetary markets and a strong lawful structure.

Furthermore, analyze the track record of the territory, as a well-regarded area can boost your company's integrity and help with smoother global purchases. Understanding the neighborhood financial system and the accessibility of expert services is additionally essential, as these will certainly support your firm's functional demands.

Ultimately, a cautious analysis of these elements will lead you in picking a territory that straightens with your service objectives, decreases threats, and optimizes possibilities for development in the global industry.

Lawful Factors To Consider and Conformity

What legal factors to consider must be thought about when creating an offshore company? Understanding the regulative structure of the chosen territory is vital. Each jurisdiction has its very own regulations governing company development, taxes, and reporting commitments, which must be thoroughly examined to make certain compliance.

Furthermore, it is important to take into consideration global regulations, particularly those relevant to anti-money laundering (AML) and combating the financing of terrorism (CFT) Many jurisdictions require confirmation of the helpful proprietors and may enforce strict due diligence procedures.

Tax obligation implications also play a crucial role in legal considerations - offshore company formation. While offshore firms can supply tax obligation advantages, adhering to both local and international tax obligation guidelines, including the Common Coverage Criterion (CRS), is needed to prevent potential penalties

Furthermore, intellectual residential property legal rights, employment laws, and legal commitments must be assessed to safeguard the offshore firm's rate of interests. Consulting with lawful and financial professionals experienced in overseas operations can mitigate threats and make certain that all legal needs are fulfilled. In summary, a comprehensive understanding of the lawful landscape is imperative for effective overseas company development and operation.

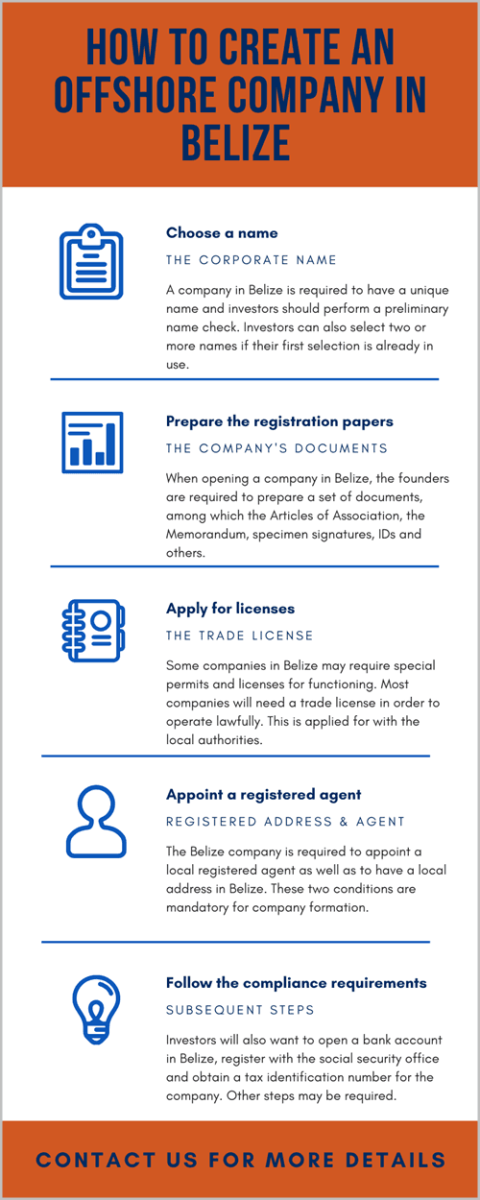

Steps to Type an Offshore Business

Choosing to establish an offshore firm entails numerous essential actions that call for cautious preparation and execution. The very first step is to perform detailed research study on possible jurisdictions that supply positive tax obligation routines, legal structures, and business laws that line up with your objectives. After picking a jurisdiction, the following action is to select a business framework, such as a restricted obligation business (LLC) or a worldwide service firm (IBC)

Once the structure is established, it is important to prepare and send the essential incorporation files, which normally consist of the company's memorandum and short articles of organization, in addition to information of the investors and supervisors. Involving a neighborhood representative the original source or provider can facilitate this process, making sure conformity with neighborhood regulations.

Adhering to unification, you must open a corporate savings account, which may need paperwork confirming the company's legitimacy and function. Guarantee ongoing compliance with regional regulations, including yearly filings and tax obligations, to maintain your company's good standing. By thoroughly following these steps, business owners can successfully browse the offshore firm formation process and unlock global service chances.

Typical False Impressions Regarding Offshore Companies

The facility of an overseas company is usually shrouded in mistaken beliefs that can bring about misunderstandings about its true nature and objective. One prevalent misconception is that overseas companies are only for tax evasion. While tax optimization navigate to these guys is a legitimate advantage, numerous overseas territories provide robust lawful frameworks that advertise compliance and openness.

An additional common mistaken belief is that overseas companies are naturally unlawful or underhanded. Actually, lots of companies use offshore entities for reputable factors, such as property security, access to global markets, and enhanced personal privacy. It is essential to set apart between legal illegal tasks and offshore methods.

In addition, some believe that offshore firms are specifically for big firms or wealthy individuals. Entrepreneurs and tiny service owners progressively acknowledge the benefits of offshore structures for operational flexibility and growth.

Finally, there is a mistaken belief that managing an overseas firm is exceedingly complicated. While it needs diligent compliance with neighborhood laws, numerous provider provide detailed assistance to browse the formation and maintenance procedures. By resolving these misconceptions, people and companies can much better recognize the strategic benefits of overseas firm formation.

Conclusion

In recap, overseas business development presents considerable benefits for services looking for to expand globally. Eventually, the strategic formation of offshore entities offers as a sensible path to unlock diverse global service possibilities and advertise sustainable growth in a progressively interconnected market.

Offshore firm development presents a tactical opportunity for services looking for to enhance their worldwide impact and maximize functional efficiencies.In the realm of worldwide service, overseas firms offer a myriad of advantages that can dramatically boost financial techniques and operational performance. By meticulously following these steps, entrepreneurs can successfully navigate the offshore company formation procedure Go Here and unlock international business chances.

By eliminating these people, myths and companies can better understand the tactical advantages of overseas firm development.

Report this page